In a world where credit cards are widely used, managing personal finances can become increasingly difficult. Overspending with credit cards is a common trap that many fall into, leading to mounting debts and financial stress. However, with a few mindful strategies, you can take control of your spending and enjoy the benefits that credit cards can offer.

Understanding the dynamics of your spending and making informed choices can pave the way for a healthier financial future. Here are some effective techniques to avoid overspending with credit cards.

1. Understand Your Spending Patterns

To effectively manage credit card spending, it's crucial to start by understanding your own spending habits. This means taking a close look at how much you spend, what you spend on, and when you usually spend. By identifying these patterns, you can better anticipate your financial behavior and make informed decisions about your spending.

Many people are surprised by their spending patterns once they analyze them. Tracking your purchases over a few months can reveal key insights into when you tend to spend more and on what categories. This self-awareness is the first step in keeping spending in check.

- Analyze your monthly spending reports.

- Identify peak spending times and categories.

- Consider emotional triggers that lead to impulsive purchases.

2. Set a Budget

Once you have a clear understanding of your spending patterns, the next step is to create a budget. A budget not only helps you allocate your resources effectively but also acts as a guideline to prevent overspending. It enables you to prioritize essential expenses and set limits on discretionary spending.

Consider using the 50/30/20 rule, where 50% of your income goes to necessities, 30% to discretionary expenses, and 20% to savings. By categorizing your spending, you'll gain a clearer picture of where your money is going and how to adjust accordingly.

Make it a habit to revisit and revise your budget regularly to adapt to changing financial circumstances and goals.

3. Use Credit Cards for Needs, Not Wants

It’s easy to confuse needs with wants, especially when using credit cards, which can make spending feel less tangible. To avoid overspending, it’s essential to restrict your credit card use primarily for necessary purchases such as bills, groceries, or unexpected emergencies. When you treat credit cards as a financial tool for essential spending, you can avoid falling into the trap of unnecessary purchases.

Before making a purchase on credit, ask yourself whether it's a need or a want. If it's not critical, it may be better to wait or use cash instead to prevent impulsive spending. By developing this discipline, you can keep your credit card debt manageable while still using credit cards effectively.

4. Avoid Carrying a Balance

One of the most effective ways to avoid overspending and falling into debt is to always pay off your balance in full each month. Carrying a balance from month to month incurs interest charges that can significantly add to your expenses, making it difficult to get a handle on your financial situation.

If you find yourself unable to pay off the full balance, it's crucial to make a plan to reduce it as quickly as possible. Start by paying off the balances with the highest interest rates first to save on total interest paid over time.

Having zero balance at the end of each month protects you from interest charges and helps you maintain better control over your finances.

- Set up automatic payments to avoid missing payments.

- Utilize budgeting apps to monitor spending and payments.

- Consider using financial tools to help track your credit card usage.

By implementing these strategies, you can help ensure that your credit card spending stays within your financial means, preventing any undue financial stress.

5. Be Cautious with Rewards Programs

Rewards programs can be enticing, but they can also lead to overspending if not managed wisely. While it is great to earn points or cashback on purchases, it’s essential to remember that the goal is to spend less, not more. Always be mindful of whether you are spending just to earn rewards, as this can result in unnecessary purchases.

Before signing up for any rewards program, consider the terms and ensure that it aligns with your spending habits. It's crucial to fully understand how to earn and redeem rewards without incurring additional debt or overspending.

6. Limit the Number of Credit Cards

Having multiple credit cards can be tempting, but it can also lead to confusion and enable overspending. Each card typically comes with its own limit, terms, and benefits, making it easy to lose track of how much you are spending collectively across cards.

It's often wise to limit yourself to one or two credit cards that you can manage effectively. This simplifies your finances and helps you stay disciplined in your spending habits.

- Choose one primary card for everyday expenses.

- Opt for a card that offers the best benefits for your spending patterns.

- Cancel any unused or unnecessary credit cards for better management.

7. Keep Track of Your Spending

Monitoring your spending regularly is one of the most effective ways to avoid going overboard with credit cards. Utilize mobile applications, personal finance software, or even traditional pen-and-paper methods to keep a close eye on your expenditures. Regular tracking can help you see where your money goes and where you may need to cut back.

Setting aside time each week or month to review your spending can reveal valuable insights. This practice can also alert you to any red flags regarding your financial habits, allowing you to adjust your budget accordingly.

- Use budgeting apps for real-time expense tracking.

- Review credit card statements monthly.

- Set reminders to analyze your spending habits periodically.

8. Stick to Your Limits

Setting spending limits on your credit cards is vital to ensure that you don't overspend. Consider setting single transaction limits or monthly spending caps according to your budget. Developing a plan for how much you can afford to spend on each credit card can also promote mindful spending.

It's important to adhere strictly to these limits. If you find yourself frequently tempted to exceed them, consider adjusting your budget accordingly or temporarily deactivating certain cards until you regain control over your spending.

9. Avoid Cash Advances

Cash advances may seem like a quick solution for immediate financial needs, but they can come with high fees and interest rates, which can compound your debt quickly. It's essential to resist the temptation to use credit cards for cash advances, as this often leads to a cycle of borrowing that can be hard to break.

If faced with an emergency, it’s best to explore other financing options or utilize savings rather than relying on a cash advance from your credit card.

- Higher interest rates for cash advances.

- Immediate fees associated with the transaction.

- Negative impact on credit utilization ratios.

By avoiding cash advances, you can steer clear of unnecessary fees and protect your financial well-being.

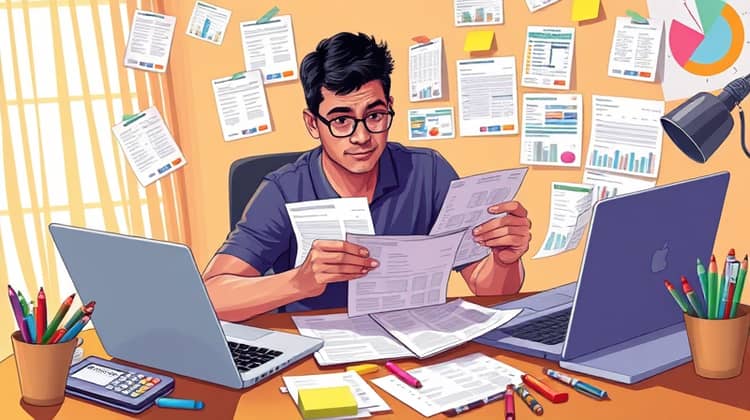

10. Regularly Review Your Statements

It’s imperative to regularly review your credit card statements for inaccuracies and discrepancies. This not only helps ensure that you are aware of all your expenditures, but it also allows you to catch any potential fraudulent activity early on. By staying vigilant, you can take proactive measures to protect your finances.

Consider going through each statement meticulously and cross-referencing your purchases. This habit can inform you about your spending patterns, helping you better align with your budget and spending goals.

11. Educate Yourself

Financial literacy plays a crucial role in managing credit card usage effectively. It’s beneficial to educate yourself about the ins and outs of credit, how interest works, and the long-term impacts of debt on your financial health. There are numerous resources available, including books and online courses, which can help bolster your understanding of personal finance.

The more informed you are, the better equipped you'll be to make smart, intentional financial decisions regarding your credit card usage.

Conclusion

In summary, avoiding overspending with credit cards requires self-awareness, discipline, and good financial practices. By understanding your spending patterns, setting a budget, and cultivating disciplined credit habits, you can enjoy the benefits of credit without falling into debt.

Adopting these strategies will empower you with the knowledge needed to manage your finances effectively and avoid the pitfalls of overspending with credit cards. Taking control of your financial future starts with mindful credit usage and a commitment to staying within your limits.