Credit cards have transformed the way we manage our finances, offering convenience and flexibility that was virtually unheard of before their introduction. However, this financial tool comes with its own set of advantages and challenges that can significantly impact your financial health. Understanding the multifaceted relationship between credit cards and personal finance is crucial for making informed financial decisions.

In this article, we will explore the history of credit cards, their pros and cons, their role in debt accumulation, and their influence on your credit score. By the end, you'll have a clearer understanding of how to effectively manage credit cards to bolster your financial health rather than hinder it.

Brief History of Credit Cards

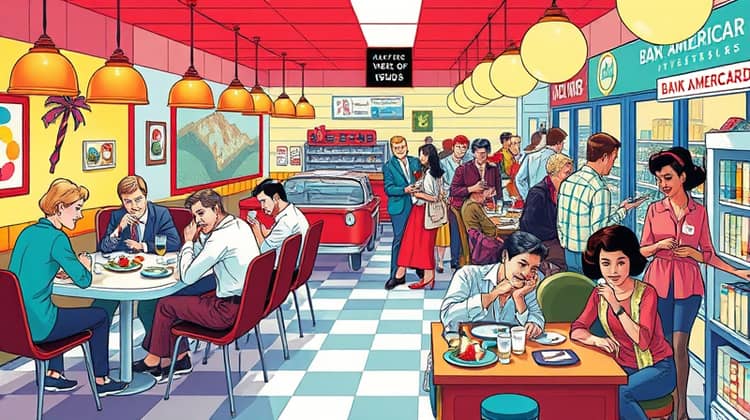

The concept of credit has been around for centuries, but credit cards as we know them today emerged in the mid-20th century. In the 1950s, Diners Club created the first charge card, allowing members to dine and pay their bills without physical cash. This innovative idea laid the foundation for what would eventually evolve into credit cards.

In 1966, the introduction of the BankAmericard, which would later become Visa, marked a significant turning point in the credit card industry. This card allowed users to carry a balance and make purchases at various retailers, thus making credit cards accessible to the general public and not just affluent individuals.

The popularity of credit cards soared during the 1970s and 1980s, with the emergence of multiple brands like MasterCard and American Express. These cards began offering benefits and reward programs, which further encouraged consumers to adopt credit cards as a staple in their wallets.

The Pros of Credit Cards

Credit cards offer a variety of benefits that can enhance your financial life when managed responsibly. One of the primary advantages is convenience. With credit cards, you can make purchases without needing to carry large amounts of cash, which is especially useful during emergencies or when traveling.

Additionally, many credit cards provide rewards such as cashback, travel points, or discounts on select purchases. These incentives can help you save money on future purchases or enjoy special benefits that cash payments simply cannot offer.

Moreover, credit cards can help build your credit score. Making regular, on-time payments signals to creditors that you are a responsible borrower, which can make it easier for you to secure loans or obtain favorable interest rates in the future.

- Convenience for purchases

- Rewards and cashback

- Credit score building

Credit Cards and Debt

While credit cards can be beneficial, they also come with the risk of accumulating debt. Many individuals struggle with credit card debt due to overspending or making only the minimum payments each month, which can lead to high-interest charges and a cycle of debt that is difficult to escape.

The flexibility of credit cards can be misleading. It's easy to lose track of how much you are spending when using a credit card, leading to a false sense of security about your financial situation. Without careful management, it's possible to find yourself in a significant amount of debt in a short period.

Understanding the implications of credit card debt is essential. Carrying high balances on your credit cards can negatively affect your credit utilization ratio, which is a critical component of your credit score and can decrease your overall financial health.

Negative Impact of Credit Cards

Credit cards can also have several negative consequences that can affect your financial stability. One major issue is the potential for high-interest rates, which can significantly increase the total amount you end up paying if you do not pay your balance in full each month. This leads to financial strain and can limit your ability to meet other financial obligations.

Moreover, the temptation of easy credit can lead to impulsive spending behaviors. Many people find themselves purchasing items they cannot afford, which can result in accumulating debt that takes years to pay off. This cycle can also contribute to financial stress and anxiety over time.

Lastly, excessive credit card use can lead to damage to your credit score if payments are missed or late. A lower credit score can affect your ability to obtain new credit, rent an apartment, or even secure employment in some cases.

- High-interest rates

- Impulsive buying habits

- Damage to credit score

In summary, while credit cards can provide numerous benefits, they can equally pose significant risks if not used wisely. Maintaining a balance between utilizing the advantages of credit cards while avoiding the pitfalls is crucial for anyone who wishes to manage their finances effectively.

Understanding the negative impacts of credit cards is the first step toward creating a healthier relationship with credit and ensuring long-term financial well-being.

Credit Cards and Your Credit Score

Credit cards play a significant role in determining your credit score, which is an essential factor in your financial life. Lenders use your credit score to assess your creditworthiness, which affects your ability to secure loans, mortgages, or even rent an apartment. Maintaining a good credit score can save you money in interest rates over time.

One of the primary components of your credit score is your credit utilization ratio. This ratio measures the amount of credit you are using compared to your total available credit. High balances can lead to a higher utilization ratio, negatively impacting your credit score. Keeping your utilization below 30% is generally recommended.

Additionally, the length of your credit history, types of credit accounts, and payment history all contribute to your credit score. Responsible use of credit cards can enhance your score, making it easier for you to achieve your financial goals.

- Maintain low balances

- Make payments on time

- Diversify credit types

Strategies for Managing Credit Cards

To ensure that credit cards contribute positively to your financial health, it is essential to adopt effective management strategies. One key approach is to create a budget that includes all expenses and planned credit card payments. This budget can help you allocate funds appropriately and avoid overspending.

Another important strategy is to pay off your balance in full each month to avoid incurring interest charges. If paying the full balance isn't feasible, prioritize high-interest debts first to reduce the overall cost of borrowing.

Finally, consider setting reminders for payment due dates to ensure you never miss a payment. Automated payments can also be a convenient option to ensure timely payments and avoid late fees.

- Create a budget

- Pay full balances monthly

- Set payment reminders

Conclusion

Credit cards can be powerful tools for enhancing your financial health if managed responsibly. They provide convenience, rewards, and can help build your credit score. However, mismanagement can lead to significant debt and financial stress.

By understanding the implications of credit card use and adopting effective management strategies, you can leverage the advantages of credit cards while minimizing their risks for a healthier financial future.